Yes, you can have Life Insurance with COPD. Getting life insurance with COPD isn’t easy though. Don’t get discouraged as we are here to help.

At this point maybe you have been told some astronomical price for a policy or maybe you were even flat out denied. This is because almost all companies don’t want to issue immediate level death benefit for people suffering from COPD.

Thankfully we know who they are and have worked very closely with them over the years. Below we will discuss everything you need to know when purchasing life insurance with COPD.

To make your experience as easy as possible contact an independent broker at senior select. We will shop, so you don’t have to.

What is COPD?

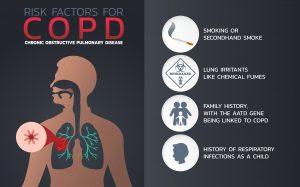

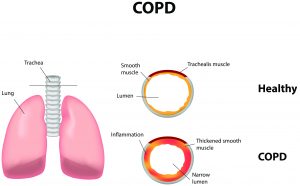

COPD stands for Chronic Obstructive Pulmonary Disease. It’s where the small airways in your lungs are damaged. This makes it very hard to breathe, in and out. Which makes you cough and wheeze. Coughing helps clear the lungs to help you breathe easier. Every breath can be difficult when living with COPD.

COPD has a drastic effect on life expectancy. American Lung Association states it is the third leading cause of death in the United States with over 15.3 million people being diagnosed with COPD. For severe COPD, the 2-year survival rate is just 50%.

There is no cure for COPD. Easing the symptoms, slowing down the progression and preventing further damage is the only real options when you have COPD.

Most people aren’t aware they have the disease until they reach advanced stages because they don’t know the early warning signs.

So, as you can see, getting life insurance isn’t an easy task for people suffering from COPD.

Get Final Expense Life Insurance Without an Exam

Final expense policies do not include an exam. We know no one likes to get poked, prodded, and weighed ever. Final Expense policies are very simplified underwriting. You will be asked to complete an application. Part of the application includes a HIPPA form which allows the carrier to see which medications you are taking. This will allow them to see if you what medications your doctor is using to treat you.

If you are using an inhaler, refilling it often, in combination with any other inhalers, you will probably have to answer as to why and what for. Medications are what lets insurance companies know what you are or have been treated for.

As part of the application, a MIB authorization is enclosed. This allows the insurer to see information from a previous life, health, disability or long-term care application. This will help them to verify your medical history without an exam.

Final Expense Life Insurance for People with COPD.

If you are using an inhaler, refilling it often, in combination with any other inhalers, you will probably have to answer as to why and what for. Even if it’s for asthma.

Medications you take let insurance companies know what symptoms you are being treated for.

Issues arise when you are on medications to treat asthma. Most of these medications that are used to treat asthma also are used to treat chronic respiratory disorders.

In this situation, we would need to get a note from your doctor that prescribed you the medications. This would have to explain what he prescribed these medication to treat.

Some of the most common medications that are used to treat COPD are:

Short-acting Bronchodilators: work quickly to treat sudden symptoms

- Albuteral (Proair HFA, Ventolin HFA, Proventil HFA, Proair RespiClick)

- Levalbuterol (Xopenex)

- Ipratropium (Atrovent HFA)

- Albuterol/ipratropium (combivent Respimat)

Long-acting Bronchodiators:

- Aclidinium (tudorza)

- Arformeterol (brovana)

- Formeterol (foradil, Perforomist, Symbicort)

- Glycopyrrolate (seebri Neohaler)

- Indacaterol (Arcapta)

- Olodaterol (striverdi Respimate)

- Salmeterol (Serevent)

- Tiotropium (Spiriva)

- Umeclidinium (incruse Ellipta)

If you have asthma, there is a good chance that you are taking one of these drugs.

Insurance companies look at how often you refill these medications. This helps them to determine the severity of your asthma.

There are also some combination drugs as well as anti-inflammatory drugs and corticosteroids. Both of these types of medications lower inflammation and make it easy to breathe.

If I smoke and have COPD can I get life insurance?

Yes, you can still get life insurance if you smoke. Life insurance carriers know there is a high correlation between people who smoke and lots of diseases.

- Lung Cancer

- Heart disease

- Diabetes

- Liver cancer

- Rheumatoid arthritis

- Colorectal cancer

- COPD

- Stroke

- Bladder cancer

- Cervical cancer

So, if you are smoking and you have COPD you will be rated up for both. The good news is most companies only ask if you smoked in the last 12 months.

So, if you are smoking and you have COPD you will be rated up for both. The good news is most companies only ask if you smoked in the last 12 months.

If you are planning on quitting smoking and waiting a year, we suggest you purchase a policy immediately and then quit. Get coverage as soon as possible, don’t wait. Just because you quit smoking doesn’t mean something else won’t go wrong in the meantime.

What if I am on Oxygen to treat my COPD?

This is a question I get a lot. All companies ask about Oxygen. Almost all companies only care if you have used oxygen in the last year. If it’s been over a year you are fine. Less than a year and it lowers your options but there are still options.

Companies offer a whole life product that is comparatively priced to a product without having COPD.

The main difference is these products have a waiting period. What this means is that they will issue you a whole life policy, that has all the benefits of a traditional whole life policy, but it won’t cover you for the full death benefit for the first two years.

If you were to pass away in the first two years your beneficiary will get all the premiums you have paid in plus a very high-interest rate. Unless you died of an accident in the first two years, then it would pay the full death benefit.

This option might not be what you were hoping but it’s the best option you have. Besides no one in the world will guarantee you 10% on your money.

How Much Final Expense Life Insurance Can I get with COPD?

Final Expense Life Insurance with a level death benefit starts at $2,000 and goes up to $45,000 depending on your age.

If you are on oxygen or have a combination of severe issues you would be able to get a maximum of $25,000. This would mean you would have a two year waiting period before full benefits would start.

Conclusion

Every final expense carrier is different. Final Expense companies don’t look at just whether you have diabetes. They look at the entire status of your health. At Senior Select we know just what companies will accept certain issues and which companies won’t. After running yourself a quick quote, give us a call, and we will help you find exactly which companies will suit your needs best.